sales tax rate in tulsa ok

A version of our address database is available for retailersvendors who may want to incorporate this information into their own systems. CITY SALESUSE TAX COPO CITY RATE CITY SALESUSE TAX COPO CITY RATE COUNTY SALESUSE TAX COPO COUNTY RATE Changes in Tax Rates.

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

2483 lower than the maximum sales tax in OK.

. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

Some cities and local governments in Tulsa County collect additional local sales taxes which can. Tulsa County Sales Tax Rates for 2022. The average local rate is 443.

The base state sales tax rate in Oklahoma is 45. Has impacted many state nexus laws and sales tax collection requirements. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766.

What is the tax rate in Tulsa County. OK Combined State Local Sales Tax Rate avg 7724. Wayfair Inc affect Oklahoma.

Sales tax at 365. The average cumulative sales tax rate between all of them is 828. Historic music venue in Tulsa Oklahoma.

11 to capital fund. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Did South Dakota v.

Tulsa collects a 4017 local sales tax the maximum local sales tax. The most populous zip code in Tulsa County Oklahoma is. 2 to general fund.

5003 DAVIS 3 2502 DAVIS. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Total Sales Tax by City.

Depending on local municipalities the total tax rate can be as high as 115. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US.

The Oklahoma state sales tax rate is currently. Cities and counties tack on as much as six and a half cents more. As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. What is the sales tax rate in Claremore OK. The purpose of the Sales Tax Overview Committee to review and report upon the expenditures of third-penny capital improvements sales tax revenues as set forth by City ordinances and the expenditure of any funds derived from the sales of General Obligation capital improvements bonds.

The December 2020 total local sales tax rate was also 4867. Search for Default Zip Code Rates. The 2018 United States Supreme Court decision in South Dakota v.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. State of Oklahoma - 45. The latest sales tax rate for Tulsa County OK.

For the 2020 tax year Oklahomas top income tax rate is 5. Effective May 1 1990 the State of Oklahoma Tax Rate is 45. The most populous location in Tulsa County Oklahoma is Tulsa.

The sales tax rate in the Tulsa city limits will remain the same 365 percent 8517 percent overall because the last temporary sales tax will expire. Of this 45 goes to the State of Oklahoma 1833 goes to Rogers County and the remaining 3 is allocated to the City of Claremore. Search By Zip Code 4.

The City has five major tax categories and collectively they provide 52 of the projected revenue. Tulsa County - 0367. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Find your Oklahoma combined state and local tax rate. Tulsa OK 74103--Customer Care.

Property taxes in Tulsa city limits will go up. Visit httpsoktaxcsaoueduoktax to download the files. The average combined tax rate is 893 ranking 6th in the US.

This rate includes any state county city and local sales taxes. The state sales tax is 45 cents per dollar. The Tulsa sales tax rate is.

You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. To review the rules in Oklahoma visit our state-by-state guide.

Oklahoma sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Oklahoma sales tax rate is currently. This is the total of state county and city sales tax rates.

Other local-level tax rates in Oklahoma are relatively complex when compared to other states local-level tax rates. The total sales tax rate charged within the city limits of Claremore is 9333. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The City of Tulsa gets about 16 percent of property tax collected in the Tulsa city limits. If a city or county is not listed they do not have a sales or use tax.

2020 rates included for use while preparing your income tax deduction. A penny increase in Oklahomas sales tax as proposed to help fund. The total tax rate might be as high as 115 percent depending on local municipalities.

OK State Sales Tax Rate. The current state sales tax rate in Oklahoma OK is 45 percent. Heres how Tulsa Countys maximum sales tax rate of 10633 compares to other counties around the.

Oklahomans are paying anywhere from 5 cents to 11 cents on the dollar in sales or use taxes depending on the city and county they live in. The Tulsa County sales tax rate is. Avalara provides supported pre-built integration.

The 2018 United States Supreme Court decision in South Dakota v. The County sales tax rate is. You can print a 8517 sales tax table here.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. There is no applicable special tax. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

Oklahoma state use tax must be paid on tangible personal property purchased and.

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Total Sales Tax Per Dollar By City Oklahoma Watch

Oklahoma State Tax Ok Income Tax Calculator Community Tax

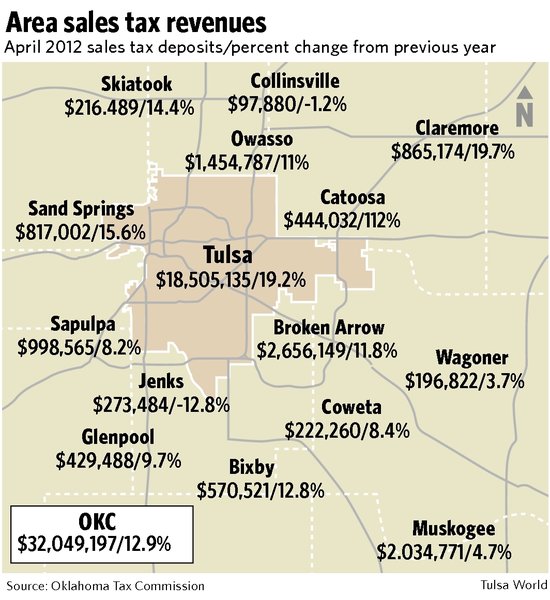

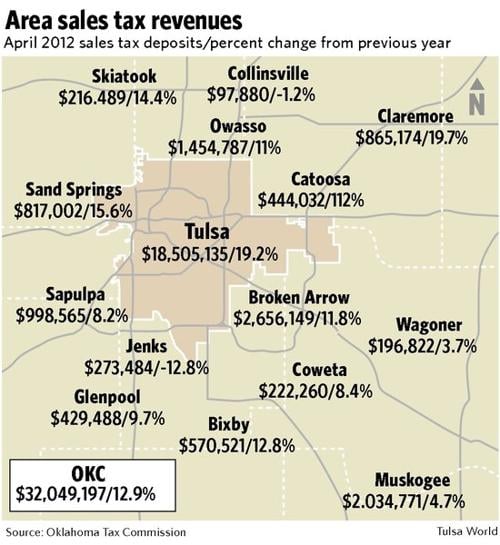

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Sales And Use Tax Rate Locator

How To File Taxes For Free In 2022 Money

Oklahoma Sales Tax Small Business Guide Truic

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Taxes Broken Arrow Ok Economic Development

Use Tax For County Government Oklahoma State University

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Handbook 2022

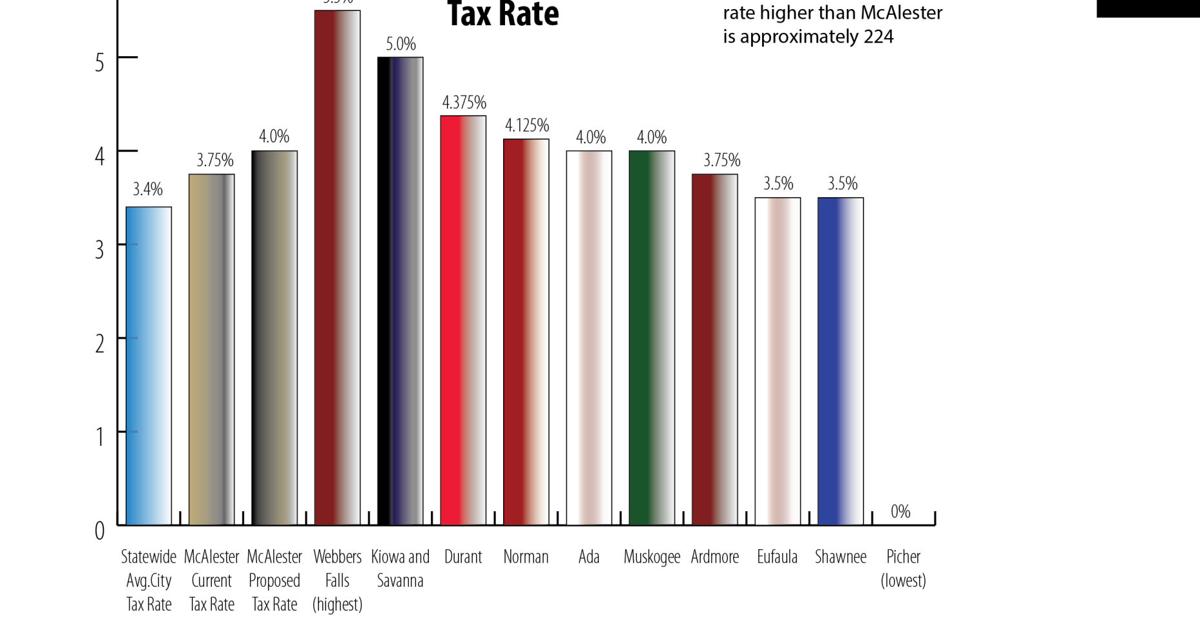

Many Sales Tax Rates Across Oklahoma Higher Than Mcalester S Local News Mcalesternews Com

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines