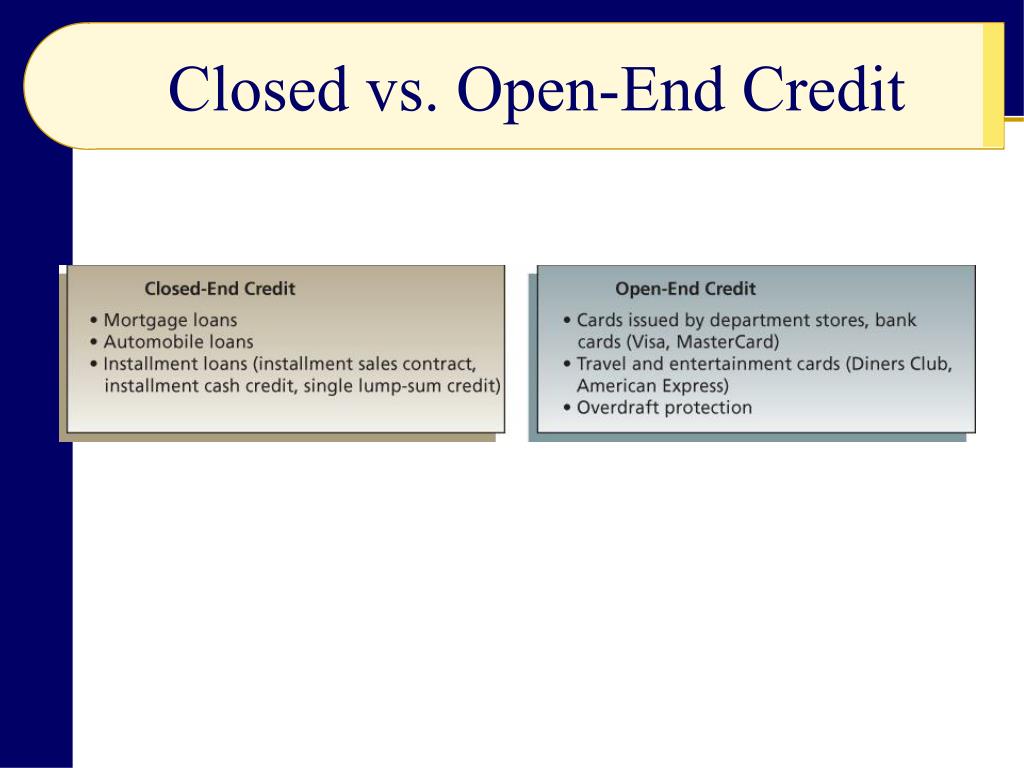

closed end loan vs open end

Two Types of Credit. The one you choose determines.

Mutual Fund Closed End Funds Vs Open Ended Funds Estate Market Fund Insurance Loan

Installment loans including a 144-month auto loan are examples of closed.

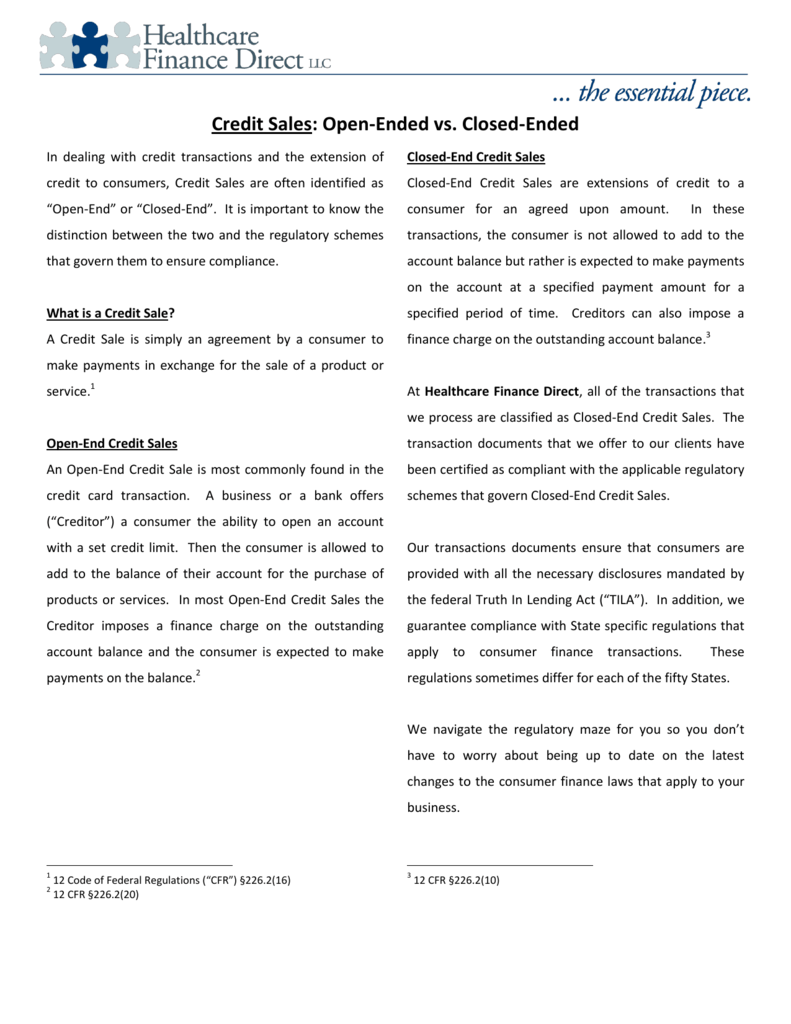

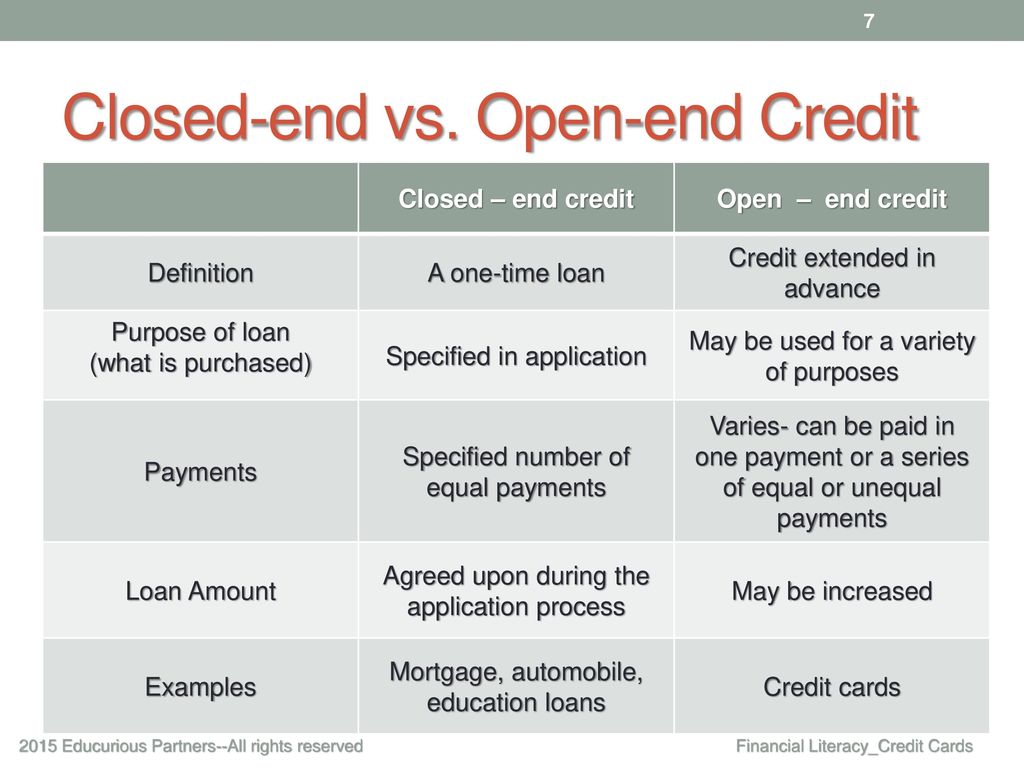

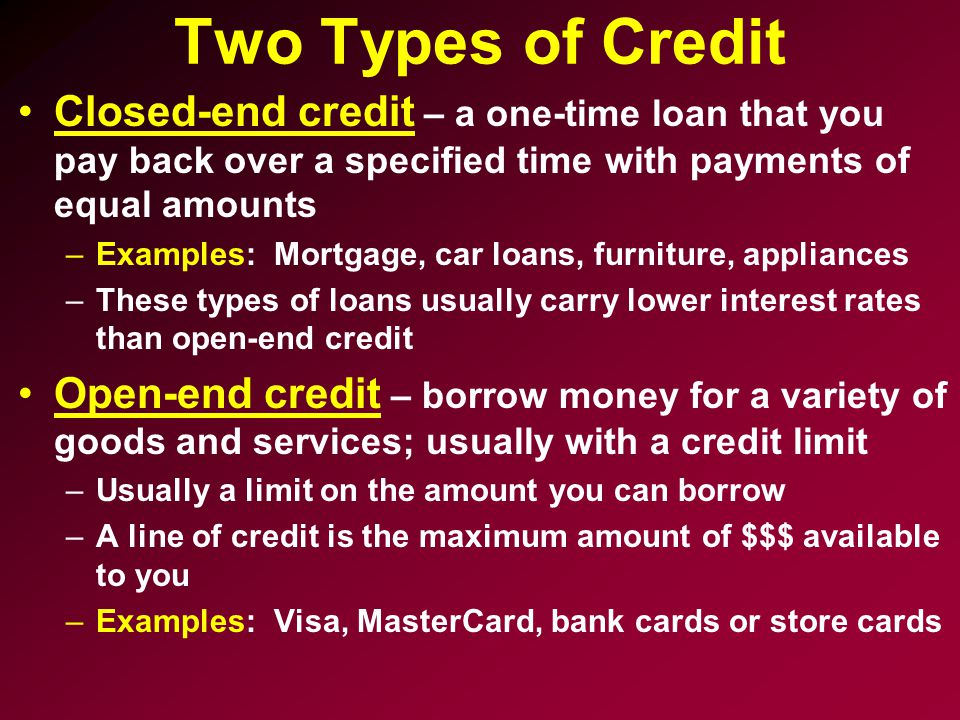

. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage. Open Ended Loans. When it comes to paying off your mortgage you need to decide between two payment structures.

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. Consumer credit falls into two broad categories. A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date.

Closed-end funds are more likely than. Are loans that allow you to put money in make a payment and take money out make charges or cash with-drawls. These loans have credit limits that.

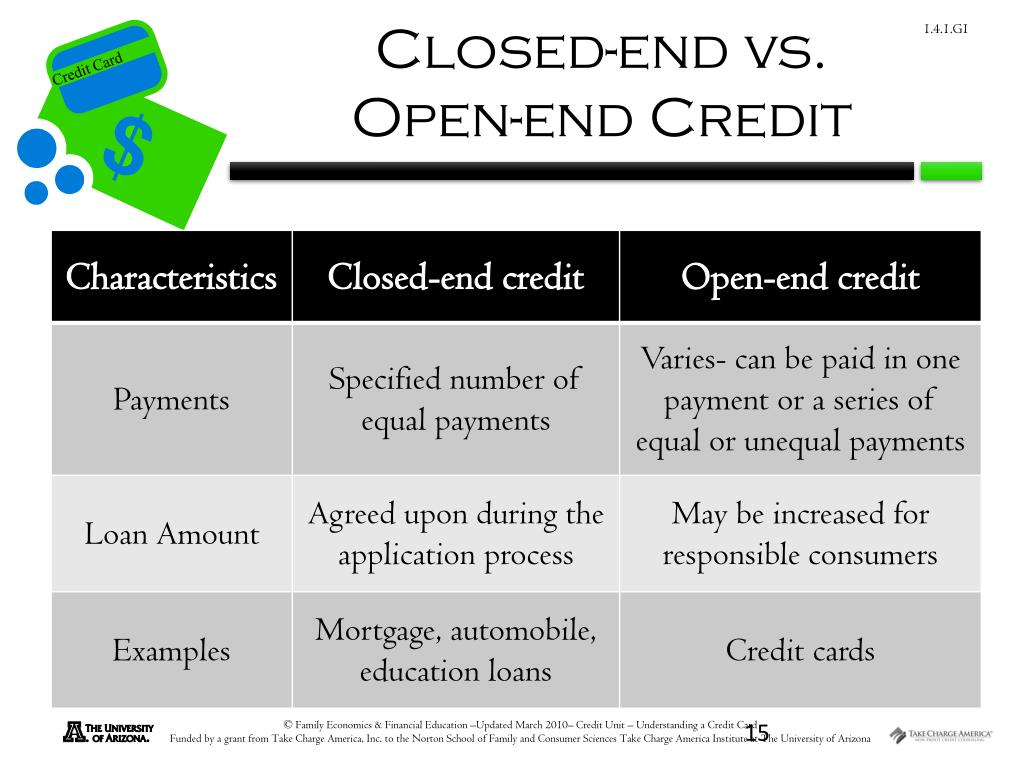

Closed-end credit usually has a lower interest rate than open-end credit which makes it better. Occasionally you might have closed-end credit with a variable interest rate. A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest.

It remains open and it. Consumer lending products aka consumer loans can be open-end credit or closed-end credit. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments.

In addition after an open end loan is approved the terms can change at any time which can be a double-edged sword. Closed-end installments and open-end revolving Closed-end credit. A line of credit is a type of loan that borrowers can take money from over time rather than all at once.

There are two basic kinds of lines of credit. Since market demand determines the price level for closed-end funds shares typically sell either at a premium or a discount to NAV. While both options use the cars residual value to calculate your monthly.

Open End Credit vs. Open loans dont have any prepayment penalties while closed-end loans do. These loans are normally disbursed all at once in order for.

In other words if you try to make a payment other than the. Open-end leases and closed-end leases are two different ways of leasing a car. The borrower can reuse.

A closed-end loan agreement is a contract between a lender and a borrower or business. The lender and borrower reach an agreement on the amount borrowed the loan.

Understanding Credit Cards Ppt Download

Not Sure What Loan Flavor Is Right For You Here S A Quick And Easy Explanation Of Unsecured Personal Loans

Understanding A Credit Card Ppt Download

Comply Partial Exemption Processing

Understanding Different Types Of Credit Nextadvisor With Time

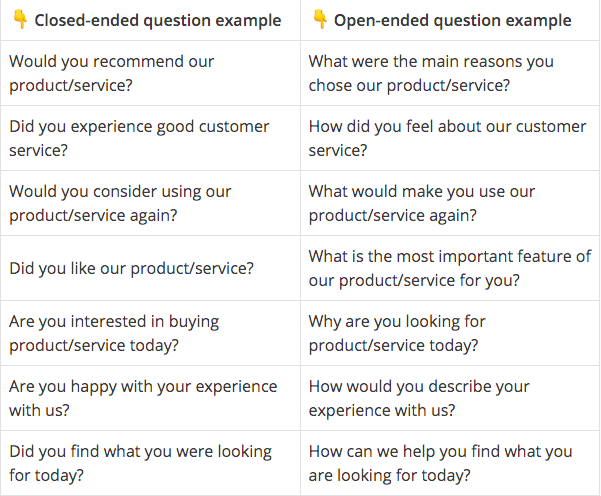

Open Ended Questions Vs Close Ended 7 Examples Hotjar Blog

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

Difference Between Open End Credit And Closed End Credit

Federal Register Home Mortgage Disclosure Regulation C Temporary Increase In Institutional And Transactional Coverage Thresholds For Open End Lines Of Credit

![]()

Mba Chart Of The Week Processing Times In Days For Helocs And Home Equity Loans Mba Newslink

Removing Closed Accounts From Credit Report Bankrate

Closed End Credit Vs Open End Credit 5115 Youtube

Truth In Lending Act Tila Consumer Rights Protections

Ppt Personal Finance Powerpoint Presentation Free Download Id 6166435

Ppt Chapter 6 Credit Use And Credit Cards Powerpoint Presentation Free Download Id 5727535

Chapter 6 Consumer Credit Ppt Download